CVA is rapidly emerging as a critical component of derivatives pricing, for non-collateralized or not fully collateralized trades

What is CVA? CVA (or Credit Valuation Adjustment) is defined as the difference in value between the risk-free portfolio and the actual value of the portfolio taking into account any counterparty credit risk, i.e., the possibility that the counterparty will default.

It is generally used to adjust the market price (for a new deal) or the MTM (for an existing deal) in order to reflect the counterparty credit risk inherent in any trade that is not 100% collateralized.

Why is knowing the CVA useful? Despite the increase in centrally cleared and collateralized trades, many instruments are still traded OTC. This means that the credit default risk of the counterparties involved in a trade must be considered in order to correctly price the trade.

Knowing what the CVA of an instrument is allows an organization to coherently measure its counterparty credit risk.

This result is mainly of interest to corporate derivatives users where collateralization is not unilaterally used across the board.

How is the CVA calculated? As it is the risk of financial loss due to the default of the counterparties involved in a trade, its calculation takes into account both of the following questions:

What is the likelihood of my counterparty defaulting?

As the counterparty can default at any point in time between the current date and the deal's maturity date, this calculation takes into account the potential for default over the entire life of the deal, using a “lifetime expectation” calculation.

This essentially means dividing the time between today and the final maturity of the trade into a set of time steps and calculating the CVA for each of those time steps. The instrument's total CVA is then the sum of the CVA over those time steps, where the default probability at each time step is the conditional probability of the counterparty defaulting by time step t given that it has not defaulted by time step t-1.

In addition, note that:

SD adds a time step for the instrument’s maturity date (if it is, for example, a swap) or its expiry date (if it is an option, for example, a swaption).

If it is an option, the CVA calculations are affected by the option’s settlement type. That is, if the option is cash settled, then the counterparty credit risk necessarily ends on the expiry date. However, if it is a deliverable, then if on the expiry date the option is exercised, the underlying instrument that will then be entered into will have its own counterparty credit risk—right up until its maturity date. Therefore, for a deliverable option, SD adds additional time steps up to the maturity date of the underlying instrument—and the CVA results calculated for these time steps are also impacted by the likelihood of the option itself being exercised.

And if my counterparty defaults, then how much money do I expect to lose?

The CVA is derived using market standard calculation based on the counterparty’s CDS curve, i.e., the credit default swap curve. This curve, together with the recovery rates (which depends on the issuer's credit rating and seniority, and is typically between 20% and 40%), is used to derive the default probability.

For a counterparty without a liquid CDS market, it is common practice to instead use a proxy for the CDS curve and recovery rates in order to calculate its CVA risk. That is, you select a company (or issuer) whose credit characteristics closely match that of the original counterparty's, and subsequently use the CDS curve and recovery rates for that proxy. When selecting a proxy, you can also optionally apply a spread to its CDS curve in order to make it closer to your counterparty, giving you full flexibility when using a proxy.

Calculating the CVA in SDX Interest Rates

Currently in the pricer, the CVA calculation is supported for the following instruments in the Single Option page:

Vanilla Swap

Cap/ floor

Swaption—but only if the underlying swap is a vanilla swap, not a general swap

Cross currency swap—but only if the floating leg(s) are based on a vanilla swap, not a general swap

In the pricer, after calculating the supported instrument for which you want to see the CVA results, you load it to the Credit Check window. You do this by clicking the CVA button on the ribbon bar in the Sales tab (as seen in Figure 1).

Figure 1: Accessing the Credit Check Window

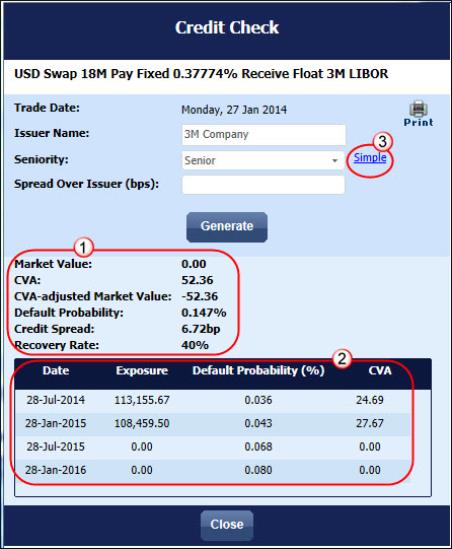

In the Credit Check window (as seen in Figure 2) you define your counterparty (or proxy) by selecting an issuer name and, optionally, defining a spread—SD then uses that issuer’s CDS curve and recovery rates (shifted by the spread if defined) to calculate the CVA-related results. You do this in the Advanced mode (accessed by clicking the Advanced link).

Alternatively, instead of defining an issuer name, you can define a particular sector of the economy. To do this you use the Sector and Rating fields in the Simple mode, which is accessed by clicking the Simple link as seen at 3 in Figure 2.

When you then click Generate, SD divides the time between today and the final maturity of the trade into a set of time steps (which are set by default to every 6 months), and calculates the CVA for each of those time steps, before summing these results up to give you the instrument's total CVA.

|

|

SD calculates the results in the CVA window for the current trade date using the current rates, and for a historical date using the market data saved on that date at the cut-off time selected in the pricing page. |

Figure 2: The Credit Check Window

To calculate an interest rate instrument's CVA:

| 1. | In the Single Option page, price a supported instrument and then calculate it. |

| 2. | On the ribbon bar in the Sales tab click the CVA button. |

| 3. | In the Credit Check window, if you are in: |

The Advanced mode, in the Issuer Name field define an issuer name and then, if relevant, edit its seniority in the Seniority field. You can then optionally enter a spread in basis points in the Spread Over Issuer field.

The Simple mode, in the Sector field you enter the name of a particular sector of the economy, and in the Rating field you choose the relevant rating for the selected rating.

| 4. | Click Generate. |

What results are calculated in the Credit Check Window?

The following results are displayed (and as seen at 1 in Figure 2):

Market value

This is (as relevant to the instrument) the instrument's swap NPV or market price.

CVA

This is the amount by which you need to adjust the market value to take into account the counterparty credit risk. It is the sum of the CVA that is calculated for each of the underlying time steps.

CVA-adjusted market value

This is the market value adjusted to take the CVA into account, and is calculated as follows:

Market value - CVA

Default probability

This indicates (as a percentage) how probable it is that the issuer will default on its obligations by the instrument's maturity date.

Recovery rate

This indicates the expected percentage that you will recover in the event that the issuer defaults. It depends on the issuer's credit rating and seniority, and is typically between 20% and 40%.

In addition, and as seen at 2 in Figure 2, you see the following information for each underlying time step:

Date

This is the end date of the time step.

Exposure

This is the expected positive amount that is still outstanding on this instrument, i.e., it is the expected positive amount still due to be paid by the counterparty to you over the period between this time step and the instrument's maturity date.

Default probability

This is the probability that the counterparty will have defaulted during this time step, assuming no previous default.

CVA

This is the CVA for the 6-month period (between this date and the previous date), and is calculated as follows:

Default probability x expected exposure x (1- recovery rate)