Table 1: Buttons in the Single Option Page

Button

Description

SDX About

Opens the About SDX window which lets you access a list of the new features added to the system.

Horiz/Vert

Changes the orientation of the ribbon bar between a horizontal and vertical display.

Favorites

Lets you access your Favorites list.

Recent

Lets you open a list of the last ten deals you priced using the Shortcut Free Text field.

For more information click here.

Open

Opens the System Menu functionality.

Settings

Opens the Customize window.

| * | Home tab |

SDExcel

Lets you download SD's Excel add-in so you can integrate SD functionality with any Excel spreadsheet.

| * | Home tab |

Colors

Lets you change the display color.

| * | Home tab |

Open (F10)

The Open button opens the Portfolio Management window from where you can load a saved portfolio to the Single Option page.

It is important to note that:

If you select a portfolio which contains more than one option, it is automatically opened in the Portfolio page.

Loading an existing deal into either pricing page overwrites any data currently displayed.

| Note: | Loading an existing instrument into the Single Option page overwrites any data currently displayed. |

| * | Home tab |

Save

Opens the Portfolio Management window where you can save the current instrument.

| * | Home tab |

Add to Portfolio

Opens the Portfolio Management window where you can save the current deal into an existing portfolio or into a new portfolio.

| Note: | You can add an option to a portfolio as many times as you like. |

When adding a supported strip instrument (i.e., a swap strip, vanilla strip, Asian strip or forward strip) to a portfolio using the Add to Portfolio button, you must choose whether you want to add it to an existing portfolio as a single structure (by clicking the “Add as Strip instrument” option) or decomposed into its underlying instruments (by clicking the “Add as multi leg” option).

| * | Home tab |

Back Testing

Opens the Back Testing tool.

| * | Trader tab | Sales tab | Structurer tab |

Hist. Analysis

Opens the Historical Analysis window which lets you create charts of historical data for multiple variables for any period during the past 5 years.

| * | Trader tab | Sales tab | Market Data tab |

Risk Matrix

Opens the Risk Matrix which lets you see how on the current date the risk in the selected portfolios responds to changes in the underlying.

| * | Trader tab | Structurer tab |

Greeks Display

Opens the Greeks Display Window, which lets you easily look at the total risk for any portfolio–whether bucketed across the relevant contracts or tenors, or per expiry date.

| * | Trader tab | Structurer tab |

Buckets

Opens the Buckets window which displays for the current instrument the following Greeks (as relevant to the instrument) as they are distributed over the relevant underlying contracts or time buckets (i.e., the results for each underlying instrument/monthly contract):

Delta future in terms of units

Delta future in terms of lots

Gamma in terms of units

Vega in base currency

This button is only enabled for the following instruments:

For a swap, a swap strip, and time-dependent instruments such as a vanilla strip, an Asian strip, an OTC spread strip the Buckets button appears in the ribbon bar > Trader tab.

For a gas formula swap and a gas formula swap strip the Buckets button appears in the Results area.

| * | Trader tab |

Pricing Table

Opens the Pricing Table.

| * | Trader tab | Sales tab | Structurer tab |

Vol Surface

Opens the Volatility Surface for the current asset.

| * | Trader tab | Market Data tab |

Term Structure

Opens the Term Structure for the current asset.

| * | Trader tab | Structurer tab | Market Data tab |

Yield Curve

Opens the Yield Curve for the current asset.

| * | Trader tab | Structurer tab | Market Data tab |

CVA

Opens the Credit Check Window for the current instrument, where you can see the CVA results.

| * | Trader tab | Sales tab | Structurer tab |

Term Sheet

Lets you create a term sheet for the current instrument.

| * | Sales tab | Structurer tab |

Who to Call

Filters your client list to show who may be interested in the current deal.

For more information on the Who to Call feature click here.

| * | Sales tab |

Clients’ Activity

Lets you access the Client Trading Activity system where you can create a list of contacts for easy management and access.

| * | Sales tab |

CRM

Gives you access to the Blotter in SD's risk management functionality.

| * | Sales tab |

Correlations

Opens the Correlations window.

| * | Market Data tab |

Market Rates

This button is no longer active. Instead, you can access a full range of CM market data via SD’s real-time market data portal—DGX. You can access DGX by clicking the DGX tab at the top of the main pricing window, or via the SD Web site.

| * | Market Data tab |

Conversion

Opens the Conversion Factors window.

| * | Market Data tab |

Exchange Data

Opens the Exchange Prices window for any exchange traded commodity for which there are exchange prices available.

| * | Market Data tab |

Custom Assets

Opens the Custom Assets Management Window where you can manage your own assets.

| * | Market Data tab |

Blotter

Gives you access to the Blotter in SD's risk management product.

| * | Risk Mgmt tab |

Dashboard

Gives you access to the Dashboard in SD's risk management product.

| * | Risk Mgmt tab |

Select Books

Gives you access to the Book Selection window in SD's risk management product.

| * | Risk Mgmt tab |

SD Chat

Opens the SD helpdesk chat interface.

Community Chat

Opens the DGX Chat interface.

| * | Help tab |

Compo <> Quanto button

Lets you switch between entering into a composite or a quanto version of the instrument.

| * | This button is only displayed when you change the asset's base currency and only if the instrument is one of the following—vanilla, vanilla strip, Asian, Asian strip, swap or swap strip. |

Real Time radio button

Last Settlement Price radio button

For an exchange-traded option only, these radio buttons let you define whether to base the price of the instrument on the real time forward curve or the official forward curve of the last settled price instead.

| Note: | The forward curve affects the forward prices used in pricing the instrument. Since SDX Commodities & Energy utilizes the forward prices to price the instrument, using a different forward curve will affect the resultant price returned for this instrument. |

Expiry Dates & Rates

The Expiry Dates & Rates button opens the Expiry Dates & Rates window where you can see information about the underlying legs in a strip.

Fixing details

The Fixing Details button opens the Fixing Details window for the current trade.

Correlation Matrix

When pricing Asian-based options (Asian, Asian Strategies, Asian Strip and Asian Strip Strategies) or a TARN, the correlation between the underlying futures contract is taken into account.

The Correlation Matrix radio button lets you instruct the system to use the term structure correlation when pricing an Asian-based option, whose fixings are based on the nearest future.

This is the default correlation setting and means that you use a defined term structure for the correlation. To see the actual term structure used, click the Correlation Matrix button. This will open the Term Structure Correlation window, where you can also edit the figures used.

Flat Correlation

When pricing Asian-based options (Asian, Asian Strategies, Asian Strip and Asian Strip Strategies) or a TARN, the correlation between the underlying futures contract is taken into account.

The Flat Correlation radio button lets you instruct the system to use a flat correlation when pricing an Asian-based option (whose fixings are based on the nearest future). This means that the same figure is used at every point.

To do this, click the Flat Correlation radio button and in the textbox enter the flat correlation which should be taken into account when calculating these options.

Gas Formula Builder

The Gas Formula Builder button opens the Gas Formula Builder window.

| * | This button is only displayed for a gas formula forward. |

Parameter Rates & Fixings

The Parameter Rates & Dates button opens the Parameter Rates & Fixings window.

| * | This button is only displayed for a gas formula forward. |

Fixing Details

The Fixing Details button displays for a swap the dates on which the payments are to be made.

| Note: | The dates that appear by default depend on market convention. This is two business days after the end of each payment period. However, if you choose to base your fixings on exchange dates, the settlements are made two business days after the exchange date each month. |

Call <> Put

The Call button defines the terms of the contract, that is, whether the option is a call (a call option gives the buyer the right but not the obligation to buy the specified amount of the base currency at the strike on the specified date) or a put (a put option gives the buyer the right but not the obligation to sell the specified amount of the base currency at the strike price on the specified date).

European <> American toggle button

Defines whether the option is European style (a European style option can only be exercised on the expiry date) or American style (an American style option can be exercised at any point during the life of the contract up to and including the expiry date).

The style of option you choose affects the displayed results.

If you:

Select the American style for a vanilla, then you can also customize the transaction type using the OTC <> Margined toggle button.

Select the American style for an Asian with barrier, then you can also set the barrier monitoring window using the Start Date and End fields.

Select the American style for an Asian strip with barrier, then you can also customize the type of barrier window definition using the Barriers Monitor dropdown list.

OTC <> Margined toggle button

Lets you define the transaction type of an American vanilla.

| * | This button is only displayed if the instrument is a vanilla and if the instrument style is American. |

KI <> KO toggle button

Lets you define whether the option needs to be knocked in or knocked out.

| * | This button is only displayed for an Asian with barrier or an Asian strip with barrier. |

Above <> Below toggle button

Lets you define whether the option needs to be knocked in or knocked out.

It is essential to define not only the type of barrier (i.e., knock IN or knock OUT) but also the direction of the barrier (Above or Below). This is because the definition of this instrument is such that the barrier is triggered if the spot trades “at or beyond” the barrier level at any point during the barrier monitoring period. Accordingly the barrier is considered triggered even if the spot rate is already beyond the barrier level in the monitoring period and never actually crosses the level during this period.

| * | This button is only displayed for an Asian with barrier or an Asian strip with barrier. |

ATMF <> Delta Neutral

The ATMF <> Delta Neutral toggle button defines the type of ATM volatility displayed.

By default, whether this is initially set by the system to ATMF or delta neutral is determined by market convention. You can then change it.

Last Payment radio buttons

Lets you choose how to treat the last payment if on a fixing date the target redemption is hit.

Select:

Capped by Redemption to specify an exact TARN.

Paid in Full to specify a non-exact TARN.

Nothing to indicate that the last payment should not be made.

For more information on these settings see the TARN topic.

| * | These radio buttons are only displayed for a TARN-based instrument. |

Daily Vol <> Volume

The Daily Vol <> Volume toggle button defines whether the current volume is a single volume or a daily volume.

| * | This button is only displayed if you have activated the Daily Volume functionality via the Customize menu. |

Lots <> Default Unit

Defines whether the volume is defined in lots or the asset's default unit, e.g., mmBtu, oz, ton, etc.

Once you have defined the volume in either lots or the default unit, you can then toggle to the other volume definition. The system automatically converts the volume according to market convention.

For more information, on the market convention for converting a lot to megawatt hours for an instrument on electricity, click here.

Buy <> Sell

For most instruments, this button defines whether the current instrument is being bought or sold.

For some instruments, e.g., a TARN, there is a separate button that controls the direction of each of the underlying legs.

| Note: | If you use this button to change the direction of a TARN instrument, this is not the same as simply flipping the Buy/Sell direction of the underlying legs. |

Market Maker <> Market Taker toggle button

Lets you choose whether the system solves for a zero cost strategy for the market maker or for the market taker.

| * | This button is only displayed for a collar, 2-leg vanilla, 3-leg vanilla, 3-vol butterfly, vanilla strip collar, vanilla strip 2-leg, Asian collar, Asian 2-leg, Asian strip collar and an Asian strip 2-leg. It only appears in the pricing page next to one of the Strike fields after you enter z or zero cost in that field. |

Calculate

Calculates for the current option (using the displayed market data):

Greeks

Price in various terms as relevant

Refresh

If the trade date of the deal is for:

The current trade date, clicking Refresh imports the latest saved rates from the system.

A trade date in the past, clicking Refresh imports the saved end-of-day rates for that trade date.

| Note: | Reloading the market data clears the option's calculated Greeks and values. |

Clear

For the current instrument, clears all data input by the user and the system (including market data depending on user-input data, such as ATMF Volatility and the Forward rate) as well as any Greeks and values calculated by the system.

Solver F8

Activates the Solver feature.

Defines whether the results are displayed in terms of the base currency or units of the commodity.

Deal Capture

If you are registered for entering deals into a risk management system, the Deal Capture button enters this deal/portfolio directly into either of the following (depending on your user configuration):

Your own third-party system.

Lets you define your own market volatility for the current option and then recalculate its price, Greeks and other results.

| * | This button is only displayed for vanilla-based and Asian-based options. |

Lets you define your own price per unit for the current option and then recalculate its market volatility, Greeks and other results.

| * | This button is only displayed for a vanilla options and vanilla strategies (with the exception of the straddle, strangle and butterfly strategies). |

In the Single Option page the Choice button:

Indicates that a choice price has been assigned to this leg of the strategy.

For more information on how the choice price is assigned (either automatically by the system or manually by the user) see Working with Choice Prices.

Lets you toggle between seeing the bid/ask price and actual choice price assigned to this leg.

| Note: | Toggling between the views does not affect the allocation of the choice price. Nor does it affect the actual price used. When the Choice button is displayed the mid price is used for this leg price, regardless of whether you have toggled to see the bid/ask price or the mid price. |

| * | The Choice button is only displayed next to the appropriate leg(s) of the strategy once you have calculated the strategy, and only then if you first checked the Choice checkbox next to the relevant Strike field. |

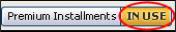

Activates the Premium Installments feature (whereby you can choose to pay the premium in installments rather than as a single payment up front) for the current instrument.

Deactivates the Premium Installments feature (whereby you can choose to pay the premium in installments rather than as a single payment up front) for the current instrument.

Toggle the units of measurement of the commodity between barrels and gallons when pricing a spread option. The value is converted using the conversion factors listed in the Conversion Factors Window.